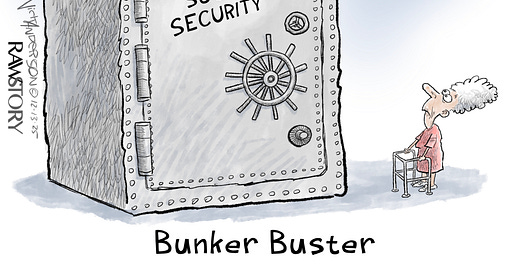

For decades, experts warned that Baby Boomers would eventually bankrupt Social Security and Medicare—and now, surprise! The bomb is ticking down to 2033. But rather than defusing it, our leaders are busy arguing about everything except fixing it.

Key threats to Social Security’s long-term stability stem from Trump administration policies, particularly regarding immigration, taxation, and tariffs:

Immigration: Immigrants contribute significantly to Social Security by paying payroll taxes, often without receiving benefits. Trump’s push for mass deportations and cuts to legal immigration would shrink the workforce, reduce payroll tax income, and worsen Social Security’s finances.

Tariffs: These could raise inflation and slow economic growth, increasing Social Security costs due to larger cost-of-living adjustments and potentially reducing payroll tax revenue in a recession.

Tax policy: Trump has proposed eliminating taxes on Social Security benefits, which would cut revenue for the program unless replaced, though no replacement plan has been offered.

The solutions are obvious:

Raise taxes (unpopular).

Tax more income (unpopular with rich donors).

Raise retirement age (unpopular with anyone who owns a back or knees).

Increase immigration (unpopular with the people who think "The Replacement Theory" is a policy memo).

Or... do absolutely nothing and hope the problem magically goes away. Spoiler: Congress picked Door #5.

While Republicans generally suggest benefit cuts (such as raising the retirement age), these disproportionately harm lower-income and minority workers, whose life expectancy gains have lagged behind wealthier Americans. Raising revenues instead—by eliminating the wage cap on payroll taxes and taxing investment income—could eliminate most or all of the program’s long-term funding shortfall.

Both parties share some of the blame—Republicans because they don’t want to raise taxes, Democrats because they keep sweetening benefits without paying for them. Voters also play their part, because any candidate suggesting actual fiscal discipline might as well campaign wearing a shirt that says: “Please don’t elect me.”

Meanwhile, bond rating agencies have noticed Washington’s magical thinking and responded by slapping America with credit downgrades.

The GOP’s usual solution? Cut benefits, raise the retirement age (because apparently, we’re all living forever), and ignore that rich people stopped paying full Social Security taxes ages ago. Lifting the income cap and taxing investment income could fix the shortfall entirely, but that might inconvenience billionaires—and we wouldn’t want that.

In the meantime, retirees and workers are left to wonder if Social Security will survive, while the wealthy continue their light jog past the payroll tax finish line.

The ironic thing? Not a SINGLE America-despising, useless billionaire would miss even losing 25% of their worth, much less what? 2% each year on EARNINGS??? My fondest hope is that President Vance isn't going to be as pure evil this fall or HOPEFULLY later this month. 🤞

You draw and speak rational, sound policy. Politicians have headphones that filter all that out. Those of us who are already retired and those coming behind us will pay the price, unless they are wealthy.